Interest rate FAQs

helps you to explain

how funding solutions work.

Interest rate FAQs

helps you to explain

how funding solutions work.

Here’s our guide to how interest works on Smart Ease Payment Plans.

What is compound interest?

All Smart Ease Payment Plan proposals use compound interest to calculate monthly repayments.

Common examples that use compound interest are home mortgages and car loans.

• Compound interest is when monthly repayments are worked out based on the original loan amount plus the interest charged in previous periods.

• Put simply, compound interest is the interest paid on interest.

However most people understand simple interest better, and sometimes people confuse the two types of interest.

• Simple interest is calculated based on the original loan amount only.

• Simple interest is rarely used in commercial applications.

How does interest applied to commercial agreements differ from interest applied to residential agreements?

Many retail markets, including the residential solar market, are serviced by lenders who offer “$0 interest” products.

While this sounds attractive, in reality interest is included as a hidden fee. This fee is usually passed on to the vendor, who may then increase customer-facing prices to absorb it.

Smart Ease commercial funding agreements are completely different.

Our interest is calculated monthly, using the same method that banks rely on to set mortgage repayments.

This means the cost of borrowing the money is the responsibility of the borrower, not our Channel Partners.

How does Smart Ease work out interest?

Sometimes, the easiest way to get your head around things is to break them down. So here’s a step-by-step example of the way we calculate interest on Smart Ease Payment Plans.

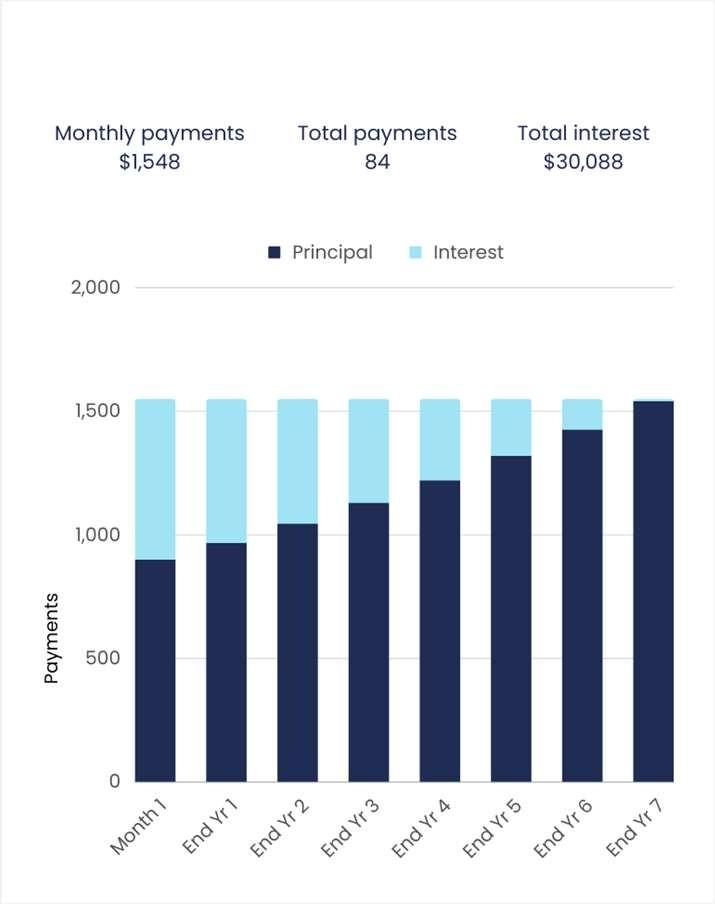

• If a business borrows $100,000 at 7.8% per annum for seven years, repayments will be around $1,548 per month (excluding GST).

• At the end of the term, the borrower will have repaid $130,088 including the principal (the original amount borrowed) and interest.

• This means they paid $30,088 in interest.

A quick look at the calculation above might give you the impression that our borrower has paid close to 30% interest.

But that’s not correct. The business in our example did not pay over the 7.8% interest they agreed to.

This example demonstrates compound interest, which is calculated based on the principal and interest owed.

Home loans demonstrate the same principle. A $500k home loan over 20 years at 5.49% interest will cost the borrower $824,787 in total. While $324,787 more than the original loan amount has been repaid, this does not represent a 65% interest rate.

How to answer customer questions on interest

When customers are considering funding solutions to buy new equipment, they may ask about how we calculate interest.

Let them know that Smart Ease funding agreements are worked out using compound interest, which is how your bank calculates your mortgage.

Tell them, too, that unlike residential solar financers, we don’t offer interest-free loans. This is because they work out more expensive for the borrower – the costs are just hidden.

Interested in making your business more sustainable?