Last week’s Reserve Bank of Australia decision to lift interest rates for the first time in over a decade was huge news. And in the commercial money market, rate increases have been almost 10x those of the RBA increase.

With an election in just over a week, the topic of rising interest rates is showing no signs of quietening down. Chances are that your commercial-solar customers may be anxious about rising interest rates and will bring it up.

Helping them to understand what’s happening, why and how it will affect them may mean the difference between closing a sale and having it fall flat.

Here’s what you need to know.

1. Understand the basics

No one is happy about it, but bear in mind that this rise is coming off the back of 18 consecutive interest-rate cuts (to a record low 0.10%).

Interest rates need to adjust to control some of the highest inflation seen in many years.

While there are lots of things that have contributed to the timing of this rise, two of the obvious causes are an almost 10% rise in the cost of fuel and the global energy shortage (particularly fossil-fuel energy).

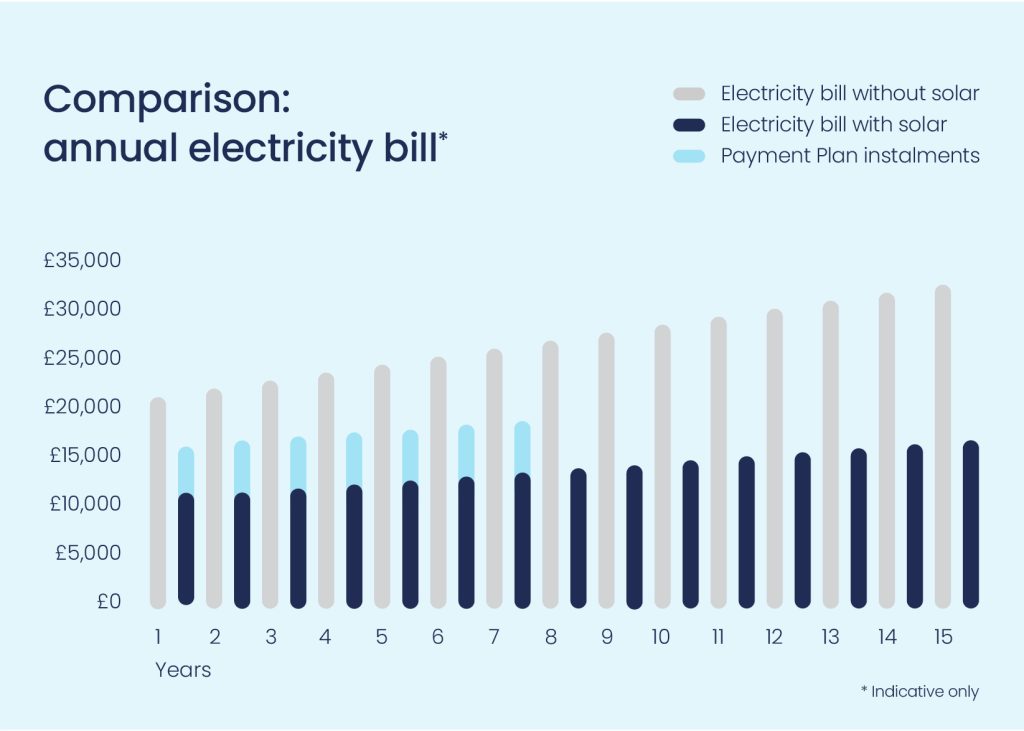

2. Remind them about “cash-flow positive” benefits

In the vast majority of cases, projects will remain cash-flow positive – even under the revised rates (especially when factoring in forecast energy price rises).

Cash flow plays a huge role in the survival of a business. One of the benefits of using a payment plan is that businesses avoid tying up capital while still taking advantage of reduced energy bills.

So while monthly payments may increase slightly, the benefits of payment plans remain.

3. Show them the actual numbers

Take a minute to do the sums for your customers to work out how much a repayment might increase. This will help them see that the dollar impact of an interest rate rise may be quite minimal.

For example, a 0.5% rate increase to the monthly repayments on a $30,000 payment plan would result in a monthly payment increase of around $8 (over both 5- and 7-year terms). While no one likes a price increase, the cost of two coffees a month is a lot lower than they might expect.

The bottom line

While there’s a window for action on credit approvals, rates are rising so fast right now that they’re being reset as often as every 30 days. Educating the market about this is the reality for our industry – as it is for all industries that use commercial finance.

For help with larger or complex projects, or for tips on conversations with your customers, please call your Account Manager. The Smart Ease team is always here to help.